You, dear reader, probably don’t come from a rich family. You probably didn’t have a trust fund waiting for you when you turned 18 (that’s how trust funds work, right?). And there’s no long line of generational wealth threading itself through your family history. And now that you’re an adult, it’s your turn to take a stab at starting the generational wealth in your family. How’s that going?

Many of us received little meaningful personal finance education from our parents. They had other challenges facing them. And honestly, many of them never figured it out either. The school curriculum didn’t help as well. We have to figure things out as we go through trial and error (mostly error, if you’re like me).

Fortunately, I’ve done enough of trial and error to have picked up a bit of knowledge about personal finances in my 33 years of life. So, gather round one and all as I share with you my humble model for starting your journey to building wealth.

TL;DR

If you want a quick summary, here it is.

Regardless of how much you earn, every paycheck must contribute to your long-term financial growth. You do this by saving a portion of your earnings every time and setting up hedges around those savings to protect them from the eventualities of life.

Here’s how you should split your earnings as soon as they hit your bank:

10% - Growth Fund: This is how you ensure your growth every month. You want this fund to grow each month so you should protect it at all costs. You're building it up to invest it. Everything else after this exists to stop you from dipping into this.

10% - Emergency Fund: This is to rescue you in case something unexpected happens. For example, you lose your job or you need to pay a large sum that you couldn't have expected.

10% - Black tax. If you're like me, you probably have black tax. Parents need to be taken care of, an uncle, a cousin, etc. It's, therefore, a good idea to expect this and put aside some money for it.

10% - Personal allowance. You need to enjoy the fruits of your labour to stay motivated. So give yourself some spending money. Buy yourself something nice.

10% - Charity. I strongly believe in giving; we all owe something to humanity beyond ourselves and our families. If that sounds like a lot of gobbledygook, then take this. Research shows that the way to use money to make yourself happy is to use it on others.

The remaining 50% should be enough to take care of all your bills and expenses (maybe with a little extra), if it's not enough, you're probably living above your means. Cut down some things.

Why you need to save

When we talk about personal finance, the conversation usually includes budgeting and other things and stops at saying save something each month. But how much should we save? In fact, why should we save in the first place? What’s the end goal?

Unless your earnings are very high, you likely won’t get rich from saving a percentage of your earnings. So what’s the point?

Saving will do two things for you.

First, it will keep your net worth growing. Your net worth is what’s left after we put together all the cash and assets you own and take out the value of all your debt and liabilities. It is the proper measure of your financial position. This is worth stating because sometimes we focus too much on what’s coming in and forget all the holes through which it leaks out and leaves us with nothing at the end of the month.

A structured saving plan will help keep you growing your net worth even whilst expenses are coming at you from all directions.

Second, there’s a lot of wisdom in the adage that “luck is opportunity meeting preparedness.” There are many profitable investment opportunities all around us, every day. Unfortunately, most of them either find us without enough “free” money to take part. Saving will ensure that you have some “free” money prepared and ready to pounce at opportunity when it avails itself.

Even if you wanted to take a more structured approach and start a business. Any business worth its salt will require some capital. It certainly helps to have some of your own to limit the amount you have to borrow from other people. Unless you’re planning to win the lottery, that capital won’t just fall on your lap. You need to build it up one brick at a time.

Saving is storing up seeds so that when planting season comes around, you can plant them and, hopefully, in due time, reap a huge harvest. This is the reason for the growth fund.

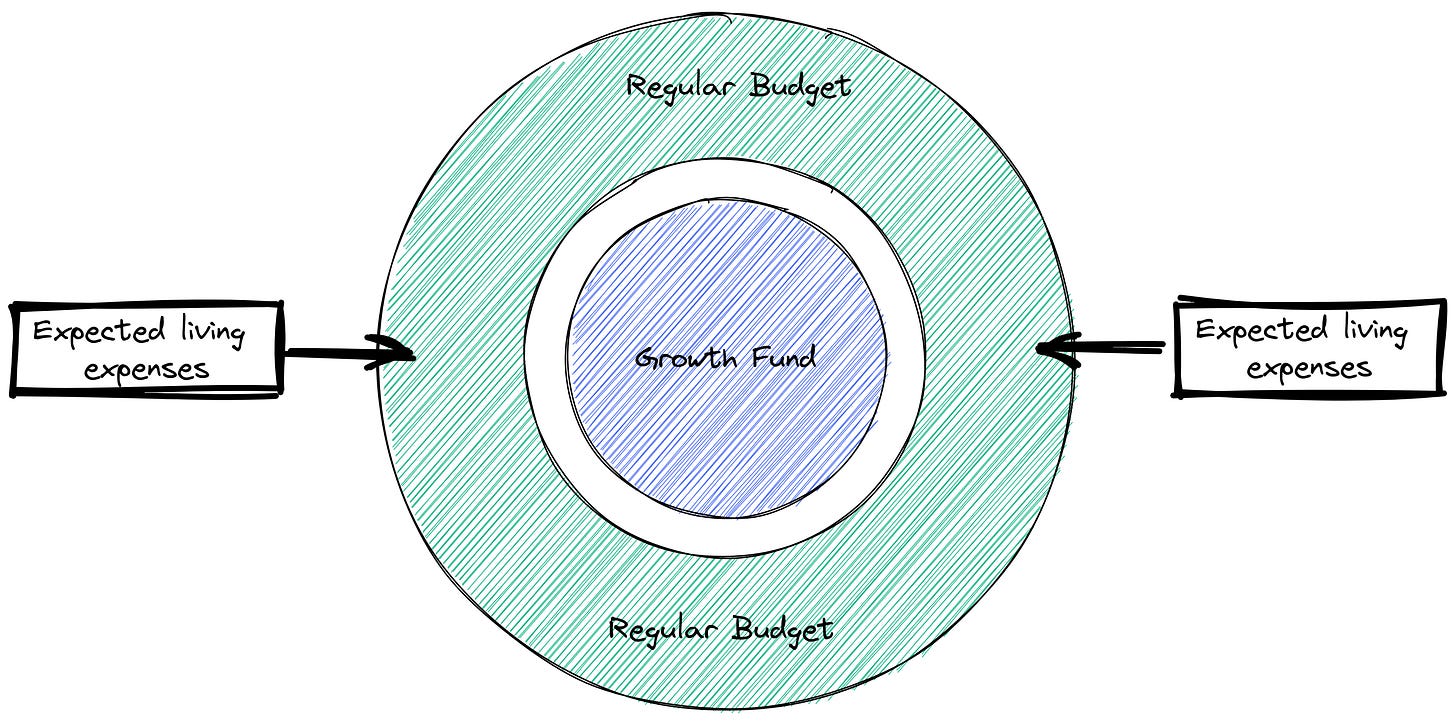

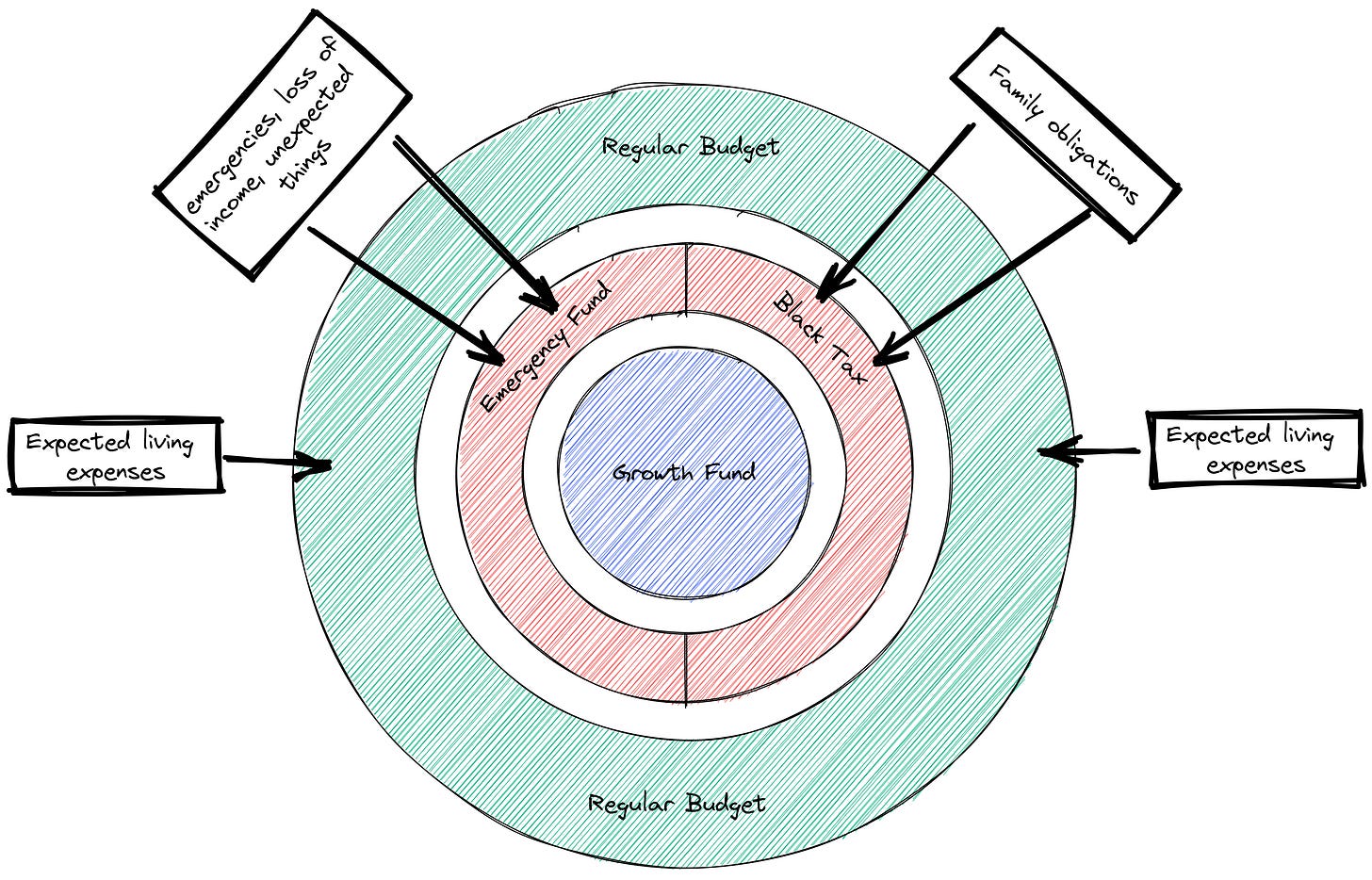

The savings mental model

The core of your structured wealth growth plan is your growth fund. From each of your earnings, put away 10% into your growth fund. Think of this as the centre of your personal wealth growth plan. It’s the creamy centre. Every expense that comes in your life is trying to get to this creamy centre and deplete it. Therefore, you need to protect it by building hedges around it.

Budget

The first, and most commonly known hedge is the budget.

The budget ensures that regular, expected living expenses don’t get to the growth fund. We can spend some time evaluating all our expenses and what we expect them to be and ensure that we don’t allow these to grow beyond what we planned. This works pretty well and we should all do it.

However, as life would have it, we can’t anticipate all costs. Some unexpected things will come that are greater than your budget can bear and will poke through it and deep into your growth fund.

Emergency fund

Your luggage will get lost while travelling, now you have to dip into your savings to buy clothes. You accidentally dropped your phone and killed it, now you need to dip into your savings to buy another phone because you need it for work. Lost your job because of COVID-19 and the job market is tight. Now, you need your savings to carry you while you look for a new job, meanwhile. Emergencies are going to try really aggressively to deplete your growth savings. You need a hedge to stop them. That hedge is your emergency fund.

There are many theories about how to do this. The most popular advice I’ve heard is to figure out your total monthly expenses, multiply that number by 6 and that gives you how much you should have in your emergency fund. That’s your target, but you arrive there by saving 10% of your earnings till you reach that target. When you reach it, you can pause the contributions and direct that 10% to the growth fund until emergencies erode the emergency fund, then you fill it up again.

That way, if something happens and you lose your income, you’ll be able to live for six months without altering your lifestyle. Of course, if you lose your income you need to downgrade your lifestyle, meaning you have an even longer runway to get yourself back on track. So, even when you lose your income, your emergency fund serves as a hedge to protect your growth fund.

Unfortunately, your personal emergencies aren’t the only thing trying to poke through. You’ve budgeted for all your expected expenses. You’ve accounted for your 6-month runway. But family obligations can emerge and poke through your existing hedges.

Family obligations

A common argument is that a major impedance to wealth building for black professionals is “Black Tax.” Some people actually feel the load of black tax so heavy that they’re left in the negative every single month.

According to Wikipedia, Black tax is “a term that originated in South Africa for money that Black (or other persons of colour) professionals provide to their family every month outside of their own living expenses, usually out of obligation. It is caused by continued economic imbalance that can be traced back to apartheid, colonialism, and slavery. It has been described as Ubuntu, but with an incapacitating twist for the black professional.”

This is very much a reality that many of us have to live with and how much of a cost it comes with varies from person to person. Whatever the amount in your circumstance If we don’t account for these costs, they also threaten to dip into our growth fund. Therefore, we need to plan for it by building a fund to take care of family obligations.

I advise putting aside between 1 - 10% depending on your circumstances. When needs arise, you don’t need to stop everything else. You’ve already made provision. And when the fund is depleted for the month, you can say that you aren’t able to help this month with a clear conscience. So if it’s a cost that can be deferred, you’ll help next month.

Would be great if this is where it stops. But threats to our growth aren’t all external. Sometimes we are our own enemies. Our own extravagance and indiscipline can threaten to throw the entire plan out the window.

Save something for yourself

All of this saving stuff can steal the joy out of your hard-earned money. To keep yourself happy and excited about your earnings, put something aside for yourself. This is not savings or for bills or any of the other “important” stuff. This is your personal allowance for splurging. You don’t have to, but if you want to this gives you the means. You can make small purchases each month. Or you can save the allowances for several months and make a big purchase later. Whatever the case, this is to help you enjoy the fruits of your labour today so that you don’t delay all your gratification.

My advice is for this to be 10% at most.

We as humans all need some meaning in our lives. We are also highly social and the needs of those around us matter to us. As good as this is, if we’re not careful, it can also threaten to poke through our hedges and dip into our growth fund.

Give away some of it

A more appropriate name for this fund would be, “The Happiness Fund”.

I recently came across a research paper titled, “If Money Doesn't Make You Happy Then You Probably Aren't Spending It Right.” The primary argument it makes is that money can actually buy happiness, but many people who have money aren’t that much happier than people who don’t because they don’t know how to spend it right.

“The correlation between income and happiness is positive but modest, and this fact should puzzle us more than it does. After all, money allows people to do what they please, so shouldn’t they be pleased when they spend it? Why doesn’t a whole lot more money make us a whole lot more happy?… Wealthy people don’t just have better toys; they have better nutrition and better medical care, more free time and more meaningful labor—more of just about every ingredient in the recipe for a happy life. And yet, they aren’t that much happier than those who have less. If money can buy happiness, then why doesn’t it? Because people don’t spend it right.… Money is an opportunity for happiness, but it is an opportunity that people routinely squander because the things they think will make them happy often don’t.” — Elizabeth W. Dunn, Daniel T. Gilbert and Timothy D. Wilson. If Money Doesn't Make You Happy Then You Probably Aren't Spending It Right.

Drawing on empirical research, the paper proposes eight principles designed to help people with money get more happiness from their money. The second of these principles is, “Use your money to benefit others rather than yourself.” How does this work exactly?

We, humans, are very social creatures. As a result, the quality of our social relationships is a strong determinant of our happiness. Because of this, almost anything we do to improve our connections with others improves our happiness as well—and that includes spending money. Several studies support this and the argument is made really well in the paper.

The bottom line is making giving or spending money on other people, a regular part of your spending routine will probably make you happier.

If you’re Christian like me, you’re likely already familiar with returning your tithes and offerings. I count these under the same banner of the Happiness fund. So put aside at least 10% to give away.

Surrounded by these hedges, your growth fund will have some substantial protection against the torrent of expenses that life throws and should be able to grow every month.

The budget, again

You may have noticed that I didn’t include a percentage for the budget as I did for every other category.

If you maxed all the rest, that should leave you with around fifty per cent of your earnings to take care of your expected bills and expenses. This should be enough to cover all of them with some left over. If this isn’t enough to cover your expenses and bills, then you’re probably living above your means and you need to make some adjustments to your cost of living.

Building the habit

Follow these principles, and in no time you should see a nice steady pot grow. If this is the first time you’re trying a structured savings plan like this. I advise you to do this for at least a year before thinking about how you can invest your growth fund. This will give it some time to grow without strain while you learn the discipline needed to see all this through.

If possible, automate it. Setup debit orders or savings pockets in your bank account. Deduct these categories first when your money lands before doing anything else.

There’s nothing like knowing you have some good savings stashed up somewhere and that emergencies won’t cripple you. But this is about more than just feeling good about your savings. It’s about wealth creation, remember? So when your savings have grown, it’s time to put them to work in building your generational wealth. And all of this is just step one. So, see you when you’ve built up your stash.